Hong Kong is a major international financial centre, and banks play a vital role in the financial system. They provide a wide range of services as financial intermediaries such as deposit-taking, lending, investment, etc. Where there is money, there could be corruption. Corruption is one of the most damaging risks faced by banks, which would not only lead to financial loss but also tarnish the reputation of banks and public’s confidence in the quality of banks as well as the overall banking system. Therefore, apart from maintaining a system of good corporate governance and robust internal controls, it is also imperative for banks to be vigilant in upholding a high integrity standard and take a proactive stance against corruption through regular risk assessment and adoption of anti-corruption measures.

To assist banks in effective corruption prevention and risk management and entrench a clean business culture in the industry, the ICAC’s Corruption Prevention Department (CPD) has, in collaboration with the banking industry, developed the Corruption Prevention Guide for Banks for reference by directors, senior management and managerial staff of banks in Hong Kong.

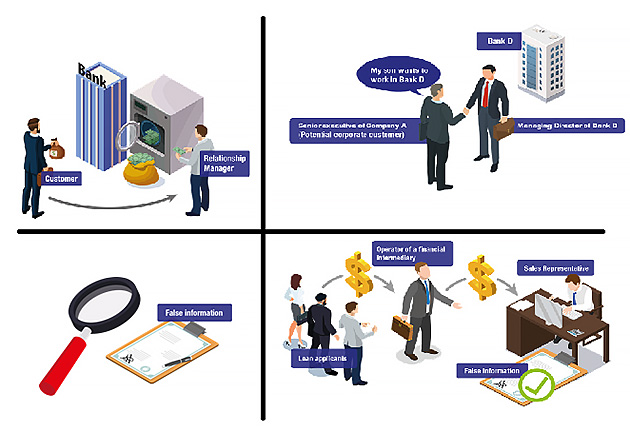

Banks would find the Guide particularly useful in enhancing their corruption prevention awareness and capabilities in their operations. Firstly, the Guide contains a number of easy-to-understand case studies based on complaints received and/or convicted case scenarios. These case studies illustrate the anti-bribery law and corruption risks under different scenarios which banks may encounter in their working environment. Secondly, based on the detailed analysis of such case studies, the Guide alerts users to common corruption risks, malpractices and red flags, and provides corresponding practicable safeguards in the core operations of banks, including management of bank accounts, credit facility and loan services, sales process and wealth management. Thirdly, apart from generic corruption prevention controls, the Guide highlights controls against corruption-related money laundering, and provides examples of measures where technology may be adopted to reduce corruption risks and enhance efficiency in their banking operations. The CPD also stands ready to provide banks in Hong Kong with corruption prevention service and tailor-made advice on the Guide upon request.

While the Guide is primarily designed for banks operating in Hong Kong, non-local banking institutions may also find it a useful reference on common issues such as ethical management, staff training and internal controls as most integrity requirements, elements of good governance and corruption prevention safeguards on a bank’s core operations can be applied to relevant institutions of other regions/countries. Banks and industry practitioners as well as banking regulators outside Hong Kong are also welcomed to download and make reference to the Guide to help enhance corruption prevention measures in their banks.

To find out more about the Guide and related services offered by the CPD, please contact the Corruption Prevention Advisory Service of the CPD through the following channels –

Tel: (852) 2526 6363

Email: cpas@cpd.icac.org.hk

Website:https://cpas.icac.hk/EN/