| Nov 1982 |

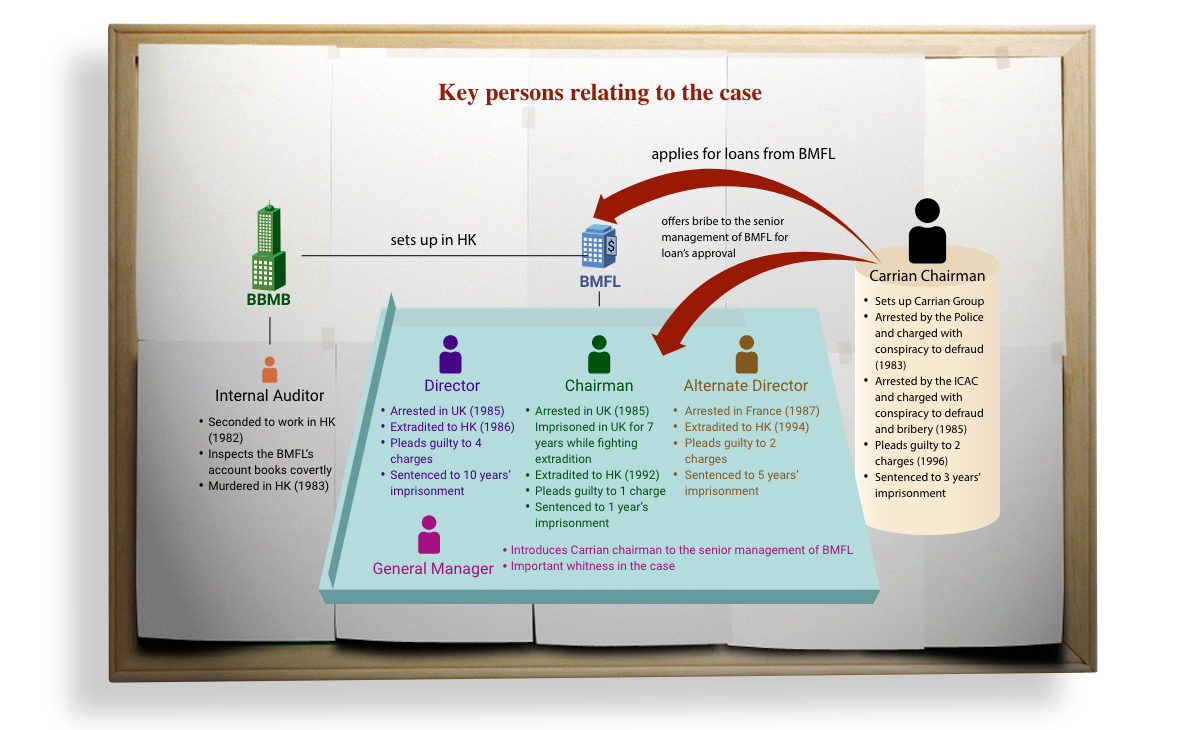

Bank Bumiputra Malaysia Berhad (BBMB), suspecting its Hong Kong subsidiary, Bumiputra Malaysia Finance Limited (BMFL), of having improperly approved loans, initiates an internal investigation and sends an internal auditor to Hong Kong to inspect the BMFL books. |

| 18 Jul 1983 |

The BBMB internal auditor is murdered and his body found inside a banana grove in Tai Po of the New Territories. |

| 4 Jan 1984 |

The Auditor-General of Malaysia, Mr Noordin, heads a three-men committee of enquiry into all BMFL-related loan payments; in late 1984, the Committee releases its interim report revealing that many loans made by BMFL were dubious. Corruption offences are alleged against several BMFL senior executives who have already resigned. |

| 12 Apr 1985 |

Since the alleged corruption offences take place in Hong Kong, a Noordin Committee member lodges a complaint with the ICAC. |

| 23 May 1985 |

The ICAC establishes a special task force, led by Principal Investigator A. Robey, to tackle the Carrian case. |

| 6 - 7 Dec 1985 |

The British police arrests the former chairman and a former director of BMFL; the ICAC simultaneously arrests the former chairman and two directors of Carrian in Hong Kong. The former Carrian chairman is charged with 43 counts of conspiracy to defraud and of illegally offering advantages totalling HK$5 billion; the three accused are released on bail. |

| 23 Nov 1986 |

On his arrest in the England, the former BMFL director agrees to return to Hong Kong to face trial. |

| 14 Jan 1987 |

The former BMFL director pleads guilty to charges of conspiracy to defraud and accepting advantages. He is sentenced to 4 1/2 years’ imprisonment. In April 1987, the Court of Appeal increases the sentence to 10 years’ imprisonment in an appeal by the prosecution. |

| Apr 1987 |

The ICAC prepares for the extradition of the former BMFL chairman on 41 counts of offences including conspiracy to defraud, conspiracy to steal, acceptance of advantages, theft and false accounting etc. He lodges an appeal in England and on ten subsequent occasions applies for writs of habeas corpus to avoid being extradited to Hong Kong. |

| 27 Apr 1987 |

A former BMFL alternate director still at large in France is arrested. Due to differences between the French and Hong Kong legal systems, he is released by the French court. |

| 5 Nov 1988 |

The prosecution drops charges against two former directors of Carrian. |

| 11 Jun 1990 |

The former BMFL alternate director, earlier released by the French court, is re-arrested by the French police. He lodges an appeal against his extradition to Hong Kong. |

| 16 Dec 1992 |

Failing in his 10th attempt to apply for habeas corpus in England, the former BMFL chairman, who has fought for seven years against extradition, is escorted back to Hong Kong. |

| 14 Jan 1993 |

The former chairmen of both Carrian and BMFL, each charged with 16 counts of bribery and conspiracy to defraud, stand trial in the High Court. |

| 25 Jun 1993 |

The former BMFL chairman pleads guilty to one count of conspiracy to defraud US$292 million and is sentenced to one year’s imprisonment. Crown Counsel describes it as one of the biggest fraud cases in history. |

| 2 Feb 1994 |

After seven years’ effort, the ICAC succeeds in extraditing the former BMFL alternate director to Hong Kong for trial. |

| 28 Feb 1994 |

The former Carrian chairman faces nine charges in the High Court, four of conspiracy to defraud and five of accepting advantages. The remaining 14 charges, though withdrawn, are placed on the record. The former BMFL alternate director, extradited to Hong Kong from France, is charged with two counts of conspiracy to defraud. |

| 14 Mar 1994 |

The former BMFL alternate director pleads guilty to two charges involving a sum of US$238 million and is sentenced to 5 years’ imprisonment. |

| 16 Jan 1996 |

The pre-trial of the case against the former Carrian chairman commences. |

| 21 Mar 1996 |

During the pre-trial, the court revokes the former Carrian chairman’s application for bail and has him remanded to await trial. |

| 20 Sept 1996 |

The former Carrian chairman pleads guilty to two offences of conspiracy to defraud. |

| 27 Sept 1996 |

On the day of the Mid-Autumn Festival, the former Carrian chairman is sentenced to 3 years’ imprisonment. |