Imagine this scenario: Susan is a nurse at a cancer treatment clinic in Hong Kong. One of her job duties is to check the registration forms filled in by patients before arranging them to receive consultations or to undergo biopsies. When an ill-looking Mr Lee came for registration with an insurance agent, Susan hesitated for a while as Mr Lee looked a tad different from the photograph on his identity card. But Susan decided not to drill on as there was a long queue behind Mr Lee.

Susan led Mr Lee and the insurance agent to a waiting room and the pair exchanged a knowing glance. They wish they could say a big “thank you” to Susan, not for showing them to the waiting room, but for bringing them a giant step closer to the success of their critical illness insurance compensation scam.

While the scenario is hypothetical, nevertheless, insurance fraud is an alarming issue worldwide. A study showed that scammers are stealing at least US$80 billion (around HK$624 billion) from the American insurance market alone annually1. In Hong Kong, the ICAC is committed to fostering a probity culture in the regional insurance hub which houses 165 authorised insurers and about 130,000 licensed insurance intermediaries2.

ICAC Principal Investigator Miranda Cheung Ka-po, who heads an investigation group dedicated to investigating corruption cases involving the insurance industry, said the majority of practitioners in the sector operated with a high standard of professional ethics but isolated cases did exist. These mainly involved corrupt and fraudulent conduct of insurance agents, such as diverting insurance policies, taking out bogus insurance policies and making false insurance claims. Cheung warned that the modus operandi of insurance bribery scams were becoming more complicated, with more parties getting involved in the crimes.

In September 2021, the ICAC smashed two syndicates which, with suspected corrupt assistance from employees of insurance companies, defrauded insurers of HK$77 million, HK$26 million of which involved critical illness insurance compensations granted to policyholders while HK$51 million were commissions released to insurance agents.

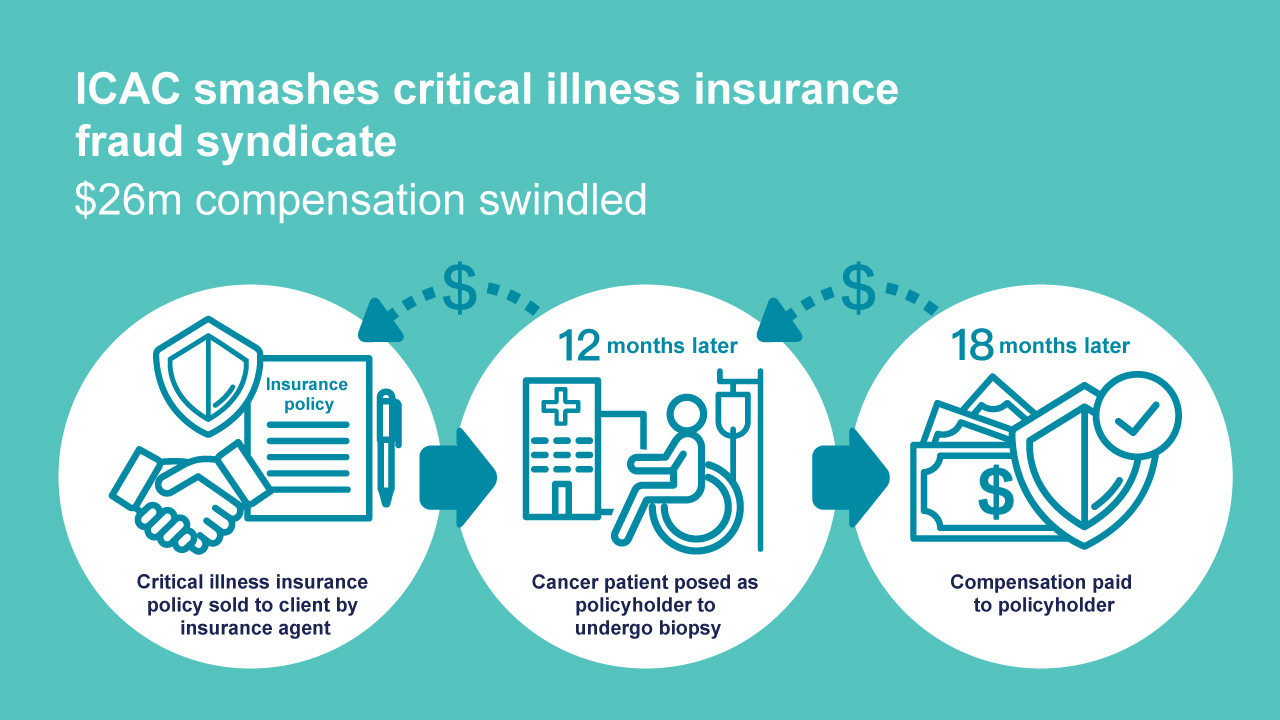

Decoding the premeditated critical illness compensation scam, ICAC Chief Investigator James Chan Ka-leung revealed that the syndicate involving an insurance agent, a policyholder, a middleman and a cancer patient. First, the insurance agent sold a high-compensation critical illness insurance policy to the perfectly healthy client. Once the waiting period of the policy was over, the cancer patient recruited by the middleman posed as the policyholder and presented himself at a medical centre for biopsies.

To make their scam even more convincing, the syndicate made sure that the cancer patient they recruited belonged to the same age group of the policyholder and bore some physical resemblance to the latter. As medical proof diagnosing the “policyholder” of cancer was issued, the insurer was subsequently deceived into releasing to the policyholder a handsome compensation.

Investigation revealed that the syndicate had used this modus operandi to defraud at least three insurance companies of compensations totalling HK$26 million, out of which HK$4.5 million was returned to the insurance agent as bribes.

Miranda Cheung reminded medical practitioners and clinic staff to stay vigilant and must carefully verify the identities of patients. Members of the public should report to the ICAC if they were invited to take part in any corrupt fraudulent scam.

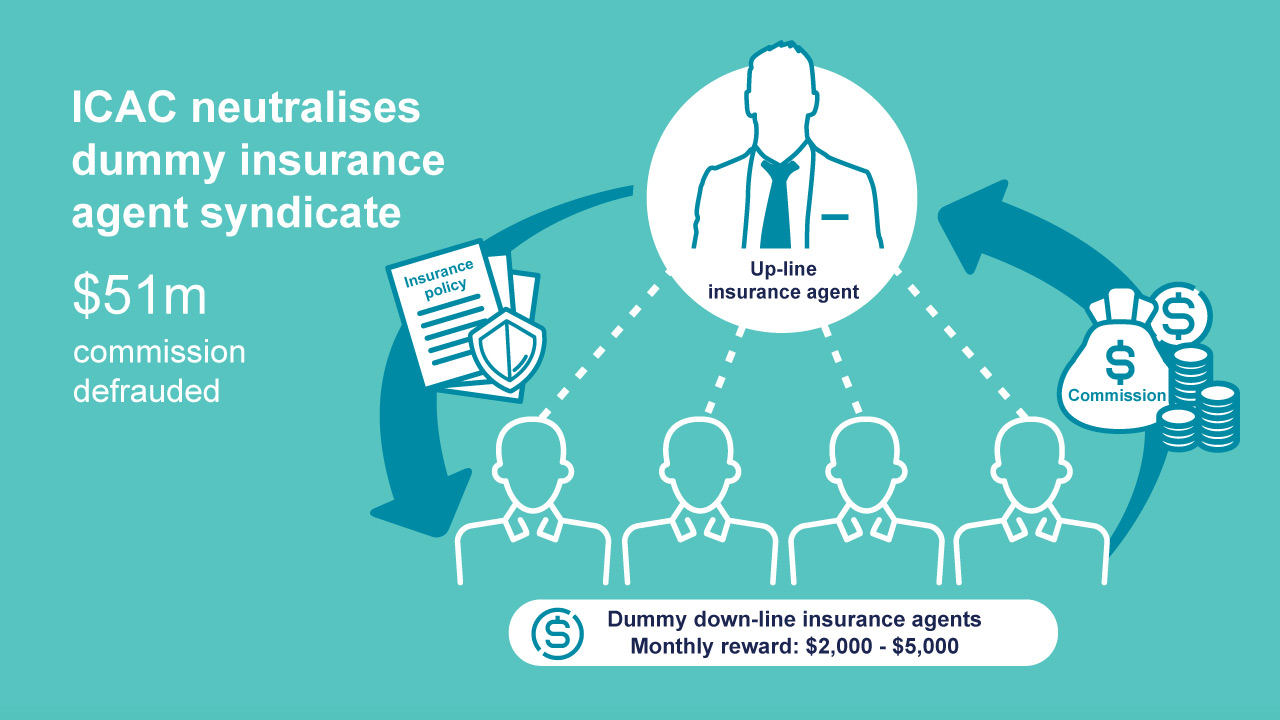

In the same month, the ICAC also neutralised another syndicate which had allegedly swindled hefty sums of commissions through dummy agents. Core members of the syndicate, who were senior employees of two insurance companies, falsely represented to the insurers that 18 agents sold as many as 480 insurance policies between 2018 and 2020. As a result, the insurers released commissions totalling HK$51 million to the agents who were dummies recruited by the syndicate. The dummy agents, mostly youngsters with limited work experience, returned the lion’s share of the commissions to the ringleaders as bribes, and only received HK$2,000 to HK$5,000 each month for taking part in the corrupt dealings.

Miranda Cheung noted that bogus insurance policies were used on various occasions so that the agents could inflate the number of insurance products they had successfully sold. Meanwhile, some agents had forged the signatures of their clients to take out other new insurance policies. She advised members of the public should consult insurers should they have any doubts about the identity of an agent or come across any suspicious dealings.

To entrench the core value of integrity in insurance industry, the ICAC launched an ethics promotion campaign in 2019. Preventive education services and resources were provided to over 3,200 insurers, insurance agencies and broker firms in Hong Kong to-date. Earlier this year, the ICAC also introduced a corruption prevention guide for insurance companies with a view to enhancing their anti-corruption capacity and internal governance. The ICAC will continue to collaborate with industry players, including Insurance Authority and the Hong Kong Federation of Insurers, through law enforcement, prevention and education.

James Chan decodes the modus operandi of insurance fraud syndicates.

Miranda Cheung reminds medical practitioners to stay vigilant and carefully verify the identities of patients.

Source of information:

1 https://insurancefraud.org/fraud-stats/

2 https://www.ia.org.hk/en/index.html