Chapter 4

The Investigation File

The ICAC investigation

Upon receiving the report from the bank, the ICAC investigating officers commenced an investigation immediately and gathered evidence from the bank. Investigation revealed that the defendant had been assisting PW2 in securities transactions since August 2014. After earning profits for the first time, the defendant requested her over the phone for a 20% share of the profits as his commission, claiming that it was a common practice in the investment industry of Hong Kong. Though caught by surprise, PW2 still agreed to pay the defendant a commission for the reasons that she had no knowledge of Hong Kong’s financial practice, and that he had indeed made profits for her. The defendant then sent her an email explaining details of an “award scheme”, in other words, the way to calculate commissions. In fact, the bank will only charge around 0.2% of the transaction value as commission. Relationship managers are not only prohibited from obtaining extra commission from clients as stipulated in the bank’s code of conduct, but also not allowed to be remunerated from clients’ investment gains.

The defendant’s first commission

On 5 October 2014, PW2 received an email from the defendant about the total profits he had made for her, and requesting for the payment of HK$141,980.68 (RMB112,093.75) as reward. The defendant asked the witness to transfer the money into his Mainland bank account, for PW2’s convenience. On 20 October 2014, PW2 transferred RMB112,093.75 from her Mainland bank account to the defendant’s Mainland bank account.

The defendant’s second commission

On 9 April 2015, PW2 received another email from the defendant about a profit of around HK$3.8 million generated from her investment in the first quarter of 2015. She was asked to deposit HK$777,140 (equivalent to RMB621,712) as reward to him into a Mainland bank account number shown in the email. On 14 April 2015, PW2 transferred RMB620,000 into the Mainland bank account.

A loss of over $7 million

The defendant had made millions of dollars of profits for the witness, but PW2’s investment account recorded a loss of over HK$7 million in August 2015. The defendant explained repeatedly to PW2 on WeChat that the loss was due to the unfavorable investment climate, and assured that all the losses would be recovered later. A deal was struck between the defendant and PW2 concerning the deduction of deficits from future investment returns, which means she only had to offer extra commission when the amount of commission exceeded the value of monetary loss.

Complaint by PW2

On 16 September 2015, PW2 received a WeChat message from the defendant about his impending departure from the bank. The new relationship manager learnt about the complaint lodged by PW2 with the Mainland branch, questioning if Hong Kong staff are allowed to obtain extra commission. When the defendant’s supervisor, namely the first prosecution witness (PW1), was aware of the case, he arranged to meet with the local branch managers and PW2 on the Mainland. PW2 showed PW1 her WeChat and email correspondence made with the defendant, and the defendant’s personal email message about the “award scheme” charging her 20% of the investment profits as commission.

Partial restitution made

Having learnt that PW2 had lodged a complaint to the bank which would conduct an internal investigation against him after his departure, the defendant requested PW2 not to disclose to the bank about his receipt of the commission and to allow him time to repay all or part of the commission received. However, PW2 insisted that she would tell the whole story anyway. On 23 September 2015, PW2 received two remittances of RMB82,700 and RMB147,000 respectively from the defendant.

Chain of events

April 2014

The defendant managed PW2’s private banking account in Hong Kong involving more than HK$10 million.

September 2014

After the first profits was made, the defendant made a request over the phone for a 20% share as his commission.

5 October 2014

The defendant sent PW2 an email listing the profits he had made and a commission of RMB112,093.75 to be paid by her, with his Mainland bank account number included to facilitate her payment.

20 October 2014

PW2 transferred RMB112,093.75 into the Mainland bank account specified by the defendant via a bank in Shanghai.

9 April 2015

The defendant sent another email to PW2 about the investment profits of about HK$3.8 million made in the first quarter of 2015, and requested for an amount to be equivalent of RMB621,712 as commission.

August 2015

PW2’s investment account recorded a loss of over HK$7 million. The defendant assured PW2 on WeChat that he was confident in recovering all of her losses later.

17 September 2015

The defendant asked PW2 on WeChat not to lodge a complaint with the bank as he would return all or part of the commission received.

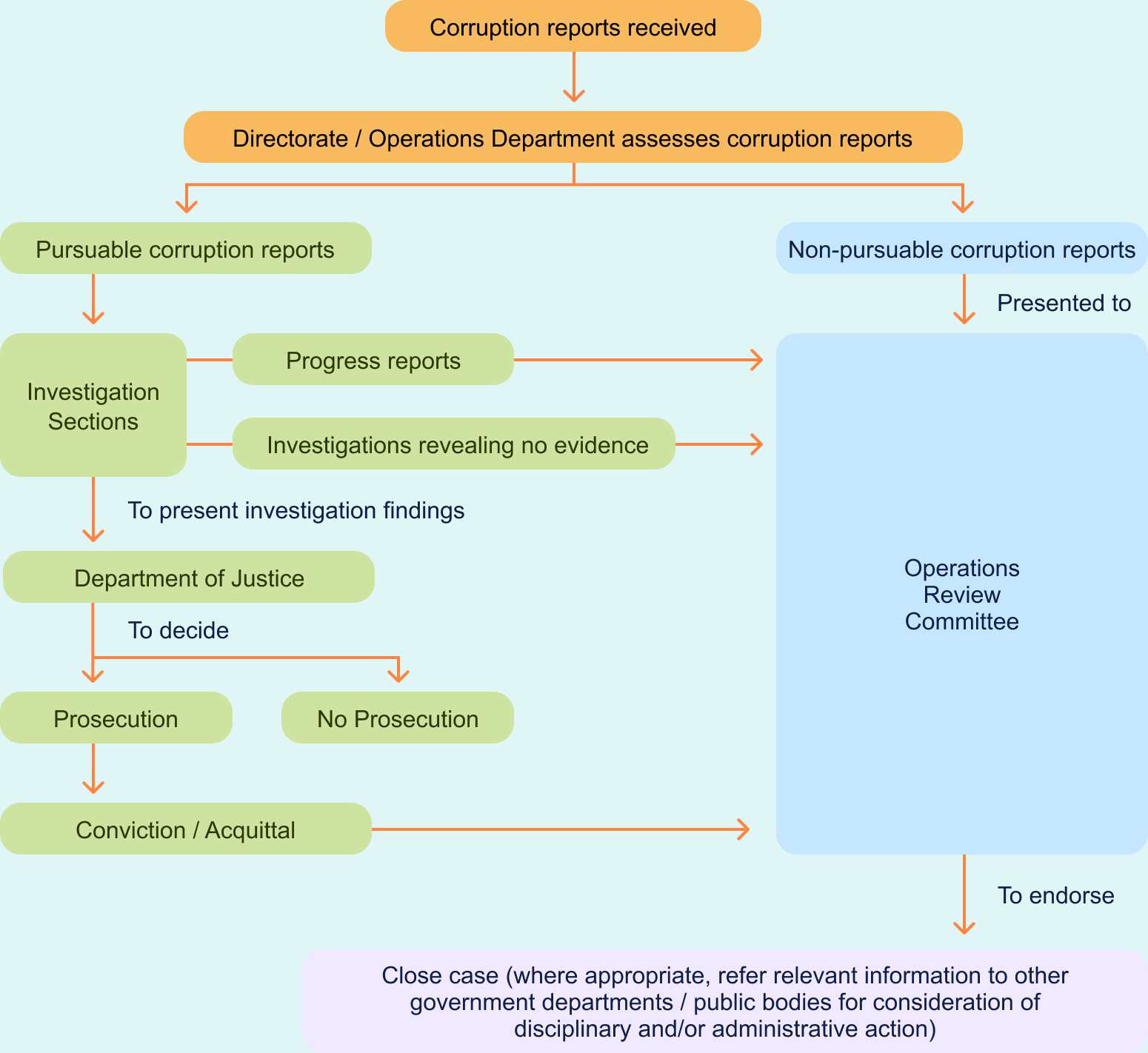

There are anonymous and non-anonymous corruption complaints. Complaints that are pursuable will be investigated by relevant investigation groups of the Operations Department. Findings will be submitted to the Secretary for Justice for deliberation and decision on whether or not a prosecution should be taken in accordance with the anti-corruption laws. Corruption reports that are non-pursuable or without sufficient evidence for prosecution will come under the scrutiny of the Operations Review Committee, an independent advisory committee overseeing the work of the Operations Department and the sole authority to terminate an investigation. For complaints that are not corruption-related, under normal circumstances, the ICAC will contact the complainant within two working days to obtain consent for referring the report to an appropriate authority.

Operations Department's complaint investigation procedures

Complainants are encouraged to make non-anonymous corruption reports so that the ICAC can get hold of more detailed and accurate information that is crucial to effective follow-up actions and investigation. Where appropriate, we will inform the complainant of the investigation outcome. The percentage of over 70% of the corruption reports received from identifiable complainants in recent years has increased the chance of successful investigation. In general, among the anonymous corruption reports where complainants cannot be reached for more information, only around 10% can be followed up. Despite the difficulties, the ICAC spares no effort in collecting evidence from different sources.